From Data to Stories

“…this book is about my journey from an unquestioning trust in numbers to an increasing focus on stories in valuation and my stories about the companies that I value in this book. I don’t expect you to buy into my stories. In fact, I hope that you disagree with me and tell your own stories and that this book will help you convert those stories into valuations.” — Aswath Damodaran

This week, our featured book is Narrative and Numbers: The Value of Stories in Business, by Aswath Damodaran.

The following is an excerpt of a post originally published by Professor Damodaran on his blog on Wednesday, January 11th, 2017.

When I taught my first valuation class in 1986 at New York University, I taught it with numbers, with barely a mention of stories. It was only with the passage of time that I realized that my valuations were becoming number-crunching exercises, with little holding them together other than historical data and equations. Worse, I had no faith in my own valuations, recognizing how easily I could move my final value by changing a number here and a number there. It was then that I realized that I needed a story to connect the numbers and that I was not comfortable with story telling, and that realization led me to start working on my narrative skills. While I am still a novice at it, I think that I have become a little better at story telling than I used to be and it is this journey that is at the core of my newest book, Narrative and Numbers: The Value of Stories in Business.

Story versus Numbers

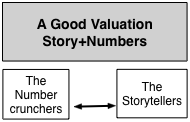

What comes more naturally to you, story telling or number crunching? That is the question that I start every valuation class that I teach and my reasons are simple. In a world where we are encouraged to make choices early and specialize, we unsurprisingly play to our strengths and ignore our weaknesses. I see a world increasingly divided between number crunchers, who have abandoned common sense and intuition in pursuit of data analytics and complex models and story tellers, whose soaring narratives are unbounded by reality. Each side is suspicious of the other, the story tellers convinced that numbers are being used to intimidate them and the number crunchers secure in their belief that they are being told fairy tales. It is a pity, since there is not only much that each can learn from the other, but you need skills in investing and valuation. I think of valuation as a bridge between stories and numbers, where every story becomes a number in the valuation and every number in a valuation has a story behind it.

When I introduce this picture in my first class, my students are skeptical, as they should be, viewing it as an abstraction, but I try to make it real, the only way I can, which is by applying it on real companies. I start every valuation that I do in class with a story and try to connect my numbers to that story and I try to be open about how much I struggle to come up with stories for some companies and have much my story has to change to reflect new facts or data with others. I push my students to work on their weaker sides when they do valuations, trying asking story tellers to pay more heed to the numbers and beseeching number crunchers to work on their stories. Seeking a larger audience, I have not only posted many times on the process but almost every valuation that I have posted on this blog has been as much about the story that I am telling about the company as it is about the numbers. In fact, having written and talked often about the topic, I thought it made sense to bring it all together in a book, Narrative and Numbers, published by Columbia University Press, and available at bookstores near you now.

From Story to Value: The Sequence

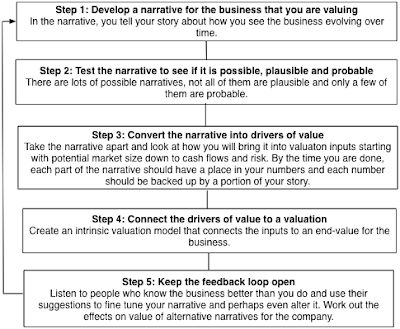

So, how does a story become a valuation? This book is built around a sequence that has worked for me, in five steps, starting with a story, putting the story through a reality check, converting the story into a valuation and then leaving the feedback loop open (where you listen to those who disagree with you the most and try to improve your story).

There is no rocket science in any of these steps and I am sure that this is not the only pathway to converting narrative to value. These steps have worked for me and I use four companies as my lead players to illustrate the process.

In the later chapters, I bring in other familiar names (at least to those who read my blog), to illustrate how macroeconomic factors affect stories and Yahoo! to examine the effect of the corporate life cycle. In the final part of the book, I turn the focus on management and look at how the story telling skills of top managers can make a significant difference in how a young company is perceived and valued by the market and how that skill set has to shift as the company ages…

Don’t forget to enter our book giveaway for a chance to win a free copy of Narrative and Numbers!