Why Money Is Undermining Our Financial System

“And this is exactly where the current problem lies: central banks – and their peers, commercial banks – still operate in a one-dimensional universe where readiness to spend has been muted. On the one hand, we now have those who have, who are thus trustworthy and who can therefore reach into the honeypot of cheap credit. But these largely own what they want and who instead of spending on things invest – thus the asset bubble and also the increasing gap between rich and poor. On the other, we have those who want to spend but don’t have the means or access to credit.” — Roman Chlupatý

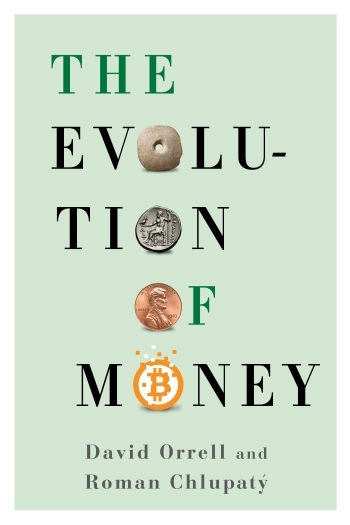

This week, our featured book is The Evolution of Money, by David Orrell and Roman Chlupatý. Today, we are happy to present an interview with Roman Chlupatý from Euronews, in which Chlupatý explains why we live in “a world where one of a few certainties is that while we don’t know when the next [economic] crisis will come, we know for sure that it will.” Watch the video or read the text in full below.

We live in a time of great monetary abnormality. Not only are the European Central Bank and the Bank of Japan prescribing negative interest rates to prop up their failing economies but the Swedish central monetary authority is doing the same – despite the fact that its national economy is growing at a solid rate. And as if this were not enough, the Fed’s Janet Yellen, who was expected to increase rates three to five times this year on her quest for normalcy, has mentioned earlier this year that negative rates in the US – meaning banks charging interest from those depositing money with them – are still a possibility.

What does this mean? Seven and a half years after the so-called crisis broke out with the collapse of investment bank Lehmann Brothers, old recipes and ways of thinking are out of breath. They certainly did help to avert the worst – just imagine what would for instance have happened in the UK if ATMs had stopped giving out cash, a situation that was mere hours away – but they did so at the cost of a 57 trillion dollar-increase in debt, as consultancy McKinsey points out, and at the cost of inflating speculative bubbles all around.

Money from state coffers and central bank vaults largely increased prices of real estate in Stockholm, powered construction of ghost towns in China and – above and beyond all, which goes for the billions printed by the banks – provided a significant boost for stock markets. In other words, instead of spinning the wheels of the real economy, as was the aim, central banks spun the wheel of largely speculative fortune since the late rise of the market does not reflect an improvement of fundamentals as much as it reflects the quest to use the abundance of cheap money that is out there.

And this is exactly where the current problem lies: central banks – and their peers, commercial banks – still operate in a one-dimensional universe where readiness to spend has been muted. On the one hand, we now have those who have, who are thus trustworthy and who can therefore reach into the honeypot of cheap credit. But these largely own what they want and who instead of spending on things invest – thus the asset bubble and also the increasing gap between rich and poor. On the other, we have those who want to spend but don’t have the means or access to credit.

The latter group – those who belong among the have-nots – represent a potential loss unless we unlock and utilize alternative dimensions of the monetary universe in which the mainstream’s spreadsheet no longer decides about the individual. In these areas, the credibility of an individual might be guaranteed by the reputation known to his neighbours but not the bank, as is the case of microcredits, or that confirmed by the blockchain. It then only follows that appropriate monies need to be readily available and acknowledged and this requires a widespread ontological shift from trust in the monopoly of national currencies to a world of democratized monetary affairs.

Needless to say, this is nothing new. The Bristol Pound and other local currencies can already be found all around the world; corporate money like Air Miles is part of a system that still pretends that national currencies are the only legal tender; and Bitcoin is moving ever closer towards the mainstream. What is new, what I am advocating, is not just acceptance of but adoration for this state of affairs by gatekeepers – by politicians, central bankers and the corporate world alike.

Such a step would match an increasingly complex, diverse yet entangled world with a thick yet elastic net of interacting monetary arrangements. These would provide for the so-called edge effect seen in nature: one can find the most diversity and the greatest new life forms in the transition zone where two ecological communities meet and influence each other; it is precisely this environment, which is both resilient and dynamic, that we need in a world where one of a few certainties is that while we don’t know when the next crisis will come, we know for sure that it will.